HVAC & the COVID-19 Novel Coronavirus: A Brief Market Assessment

The HVAC industry, like all major U.S. industries and the entire global community, is currently in the grips of the worldwide Novel Coronavirus (COVID-19) pandemic. COVID-19 has caused profound disruption across all sectors of the world economy, with potentially profound ramifications for the HVAC and home services industries. This research will identify factors of importance in the current HVAC industry landscape.

Essential Services Classification

The “essential services classification” is critical for contractors to continue operating in areas where stay-at-home orders are in effect and/or that have regulations requiring the closure of nonessential businesses. Application of this classification varies widely by state and locality, depending on how those regions interpret the federal Cybersecurity and Infrastructure Security Agency (CISA) guidelines, which only mention HVAC as essential to infrastructure in the context of maintaining data centers.

Subsequently, from a regulatory standpoint, the status of HVAC as an “essential service” is murky at best. For example, New York considers skilled trades “including electrical and plumbing” as essential services, meaning HVAC contractors can continue to do business. On the other hand, California’s regulatory language mirrors that of the CISA guidelines, officially classifying HVAC engineers among IT professionals, effectively leaving it up in the air whether residential or new construction contractors are free to operate.

HVAC’s role in maintaining medical infrastructure, the supply chain for perishable goods, and the health and comfort of millions of homebound Americans sits at the crux of the argument for classifying the industry as an essential service. As a result, industry groups like the Air Conditioning Contractors of America (ACCA) and the Air Conditioning, Heating & Refrigeration Institute (AHRI) have been actively lobbying the U.S. Congress, individual governors, and state legislatures to address this uncertainty by unconditionally classifying commercial and residential HVAC contractors as essential service providers.

In the meantime, according to an article published by ACHRNEWS, these are the states and localities where stay-at-home or business closure regulations have been issued along with the industry’s apparent classification status:

Restricted States & Localities: Are HVAC Contractors Free to Operate?

- California: Not entirely clear; Governor’s order language technically mirrors CISA guidelines for IT. However, the Governor’s FAQ makes provision for “Plumbers, electricians, exterminators, and other service providers who provide services that are necessary to maintaining the safety, sanitation, and essential operation of residences, Essential Activities, and Essential Businesses.”

- Delaware: Classified as essential, legislation specifies “specialty trade contractors”

- Indiana: Classified as essential, the legislation classifies HVAC among “critical trades”

- Louisiana: Classified as essential, so long as contractors are able to minimize contact with the public, are able to maintain social distancing, and can adhere to the ban on gatherings of 10 or more people.

- Maryland: Classified as essential, HVAC is mentioned explicitly under the list of “businesses, organizations and facilities that may remain open” by the Maryland Office of Legal Counsel.

- Massachusetts: Not clear, language mirrors CISA guidelines for IT

- Michigan: Unclear, businesses are left to interpret broad guidelines and determine for themselves whether they meet the criteria, and they’re required to provide that interpretation to workers in writing. Potentially relevant criteria for HVAC includes:

- Workers who are necessary to sustain or protect life are defined as “critical infrastructure workers.”

- Companies whose in-person presence is strictly necessary to allow the business or operation to maintain the value of inventory and equipment.

- Businesses that can facilitate the ability of other workers to work remotely.

- New York: Classified as essential, “skilled trades such as electricians, plumbers” are allowable to continue operating.

- Ohio: Classified as essential, critical trades are broadly allowable under the Governor’s order.

- Oregon: Classified as essential in the Governor’s order, so long as contractors are able to minimize contact with the public, are able to maintain social distancing, and can adhere to the ban on gatherings of 10 or more people.

- Pennsylvania: Not entirely clear, trades are listed under “construction,” and “emergency repairs permitted” is notated as an exception in Governor Wolf’s Industry Operation Guidance addendum to the executive order mandating business closures.

- Washington: Not clear, language mirrors CISA guidelines for IT

- Vermont: Not clear, business exceptions are broadly defined but the Governor’s order contains language that says “other vendors of technical, security, logistics, custodial and equipment repair and maintenance services necessary to support the COVID-19 response, critical infrastructure and national security.

- West Virginia: Classified as essential, critical trades are broadly allowable under the Governor’s order.

- Wisconsin: Not clear, the current list of essential businesses does not yet include all businesses allowable under the current order.

HVAC + COVID-19: Industry Data on Consumer Demand

Initial YOY data published by ServiceTitan through March 14th shows that call volume has only dropped 2% on average across the country since the COVID-19 crisis began; California and New York have decreased 6% and 4%, respectively.

- This same data set also shows that cancellations typically spike when an area is first hit by COVID-19, but they return to normal again in the days and weeks that follow.

- Aside from Washington, there has been no significant decrease in revenue. Completed job revenue for California was actually up, and taken with numbers from other affected regions like New York, ServiceTitan believes these trends indicate that weather (and not the virus) may have been the primary driver for decreases seen in Washington.

- The report concludes, “Even in the worst hit areas now, we can see that demand still exists. The lack of change in revenue even with the marginally lower call volume demonstrates that contractors are finding ways to sell their services on the calls they receive.”

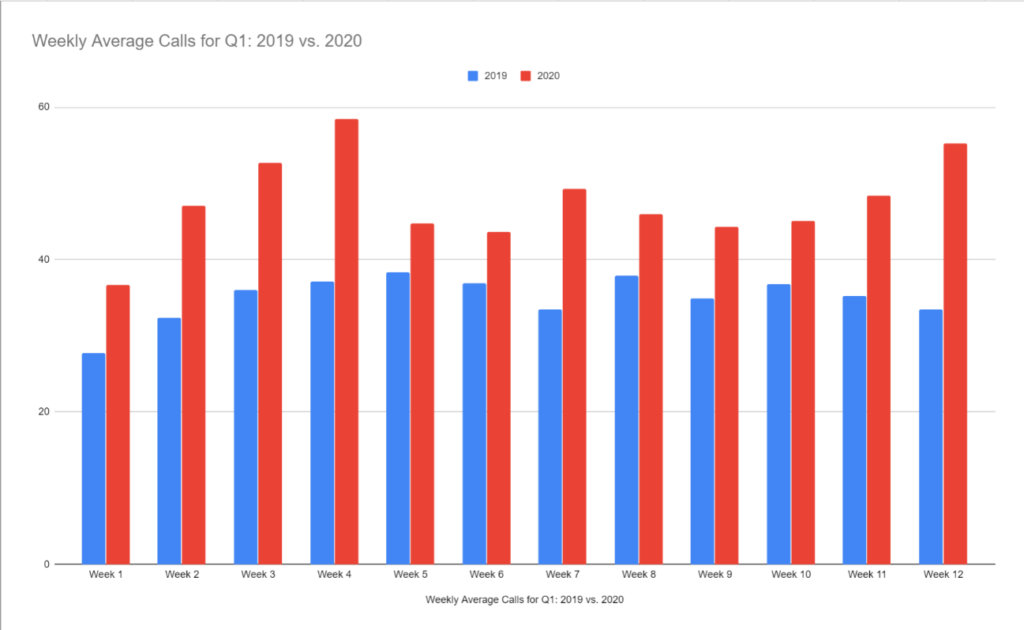

Looking now at trends identified in Mediagistic’s own client data through March 26th, we’re seeing a correlation that supports the findings in ServiceTitan’s March 14th report. We examined the performance of more than 300 HVAC contractors working with us nationwide, and overall in Q1, the average dealer’s year-over-year weekly call volume actually has risen by 36%. Some factors that may help to account for this rise include the variable impact of weather, the increased prominence of Google Local Service Ads (GLSA) in the HVAC marketing mix, and increased investment into digital marketing.

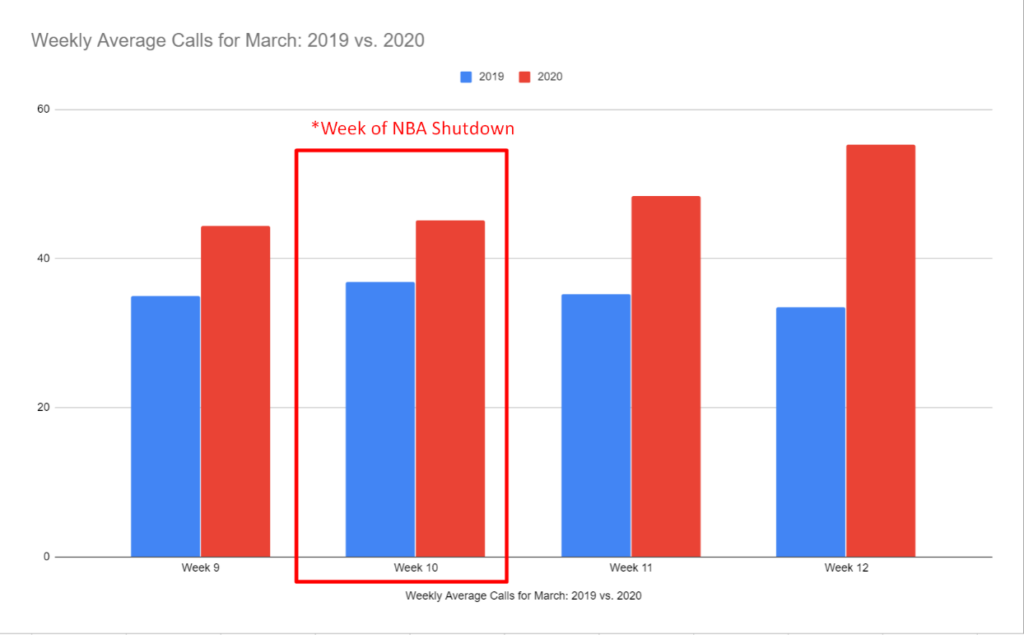

Focusing on March’s YOY numbers, we see a similar trend. Year-over-year call volume is up 37% week by week, even in the wake of the now-historic March 11th NBA shutdown. Of course, some of that call volume in weeks 11 and 12 is naturally attributable to customers calling to reschedule maintenance calls and tune-ups. However, even if we were to write off 15-20% of that additional volume to rescheduled visits or cancellations, it’s clear that HVAC businesses are getting more calls in 2020 than they did in 2019. That’s even considering the COVID-19 outbreak.

Focusing on March’s YOY numbers, we see a similar trend. Year-over-year call volume is up 37% week by week, even in the wake of the now-historic March 11th NBA shutdown. Of course, some of that call volume in weeks 11 and 12 is naturally attributable to customers calling to reschedule maintenance calls and tune-ups. However, even if we were to write off 15-20% of that additional volume to rescheduled visits or cancellations, it’s clear that HVAC businesses are getting more calls in 2020 than they did in 2019. That’s even considering the COVID-19 outbreak.

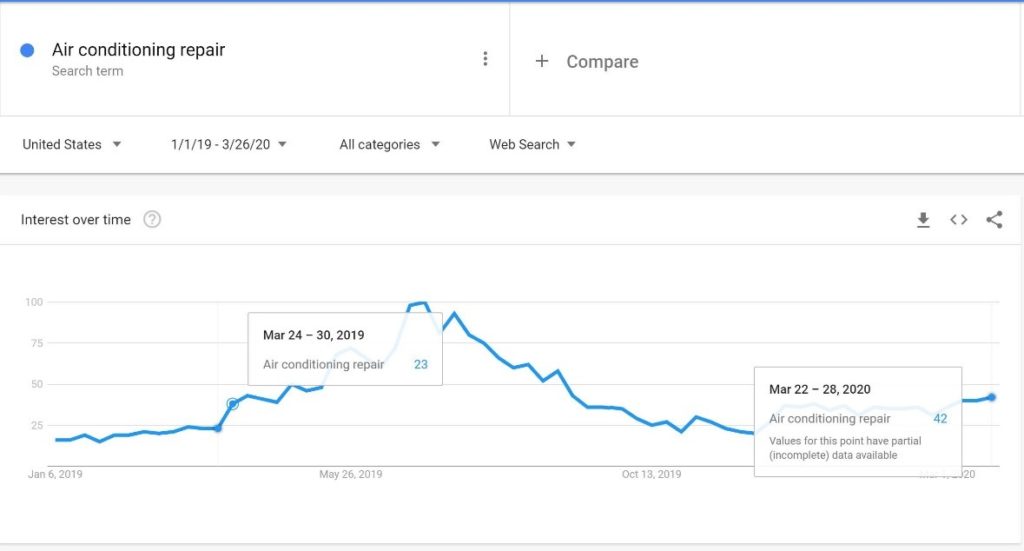

A quick look at year-over-year Google search trends for a term like “air conditioning repair” correlates as well. Overall search interest, in fact, is 82% higher in 2020.

A quick look at year-over-year Google search trends for a term like “air conditioning repair” correlates as well. Overall search interest, in fact, is 82% higher in 2020.

One thing to note regarding this data: Mediagistic does not have a large footprint of clients in New York, Washington or California. However, our book of business does include a broad array of dealers spread throughout the United States, meaning these numbers speak to the broader range of consumer sentiment nationwide.

One thing to note regarding this data: Mediagistic does not have a large footprint of clients in New York, Washington or California. However, our book of business does include a broad array of dealers spread throughout the United States, meaning these numbers speak to the broader range of consumer sentiment nationwide.

Taken alongside ServiceTitan’s March 14th report, one thing is clear: Demand for HVAC services definitely exists, and with millions of Americans spending more time at home than ever, it’s not going to disappear anytime soon.

HVAC Advertising in the COVID-19 Era: Additional Facts

Following is a list of additional facts related to the post-outbreak HVAC landscape. Although by no means comprehensive, this list offers a panoramic snapshot of what the HVAC industry’s topography looks like in the wake of this global crisis:

- HVAC—particularly indoor ventilation and filtration—is among many key building strategies currently being cited by experts as a means of slowing the spread of the disease: “When it comes to this virus, we need all hands on deck. Prevention strategies like social distancing, telework and staggered schedules, and cleaning and disinfection are key. HVAC strategies are the icing on the cake.”

- More unscrupulous players are entering the market than ever before; regulators like the New York Attorney-General have had to deploy cease-and-desist letters to HVAC businesses and brands making unsupported claims about COVID-19.

- Managing consumer reviews won’t be an issue for the time being. Google decided to temporarily halt review generation and responses on Google My Business while the crisis is ongoing.

- Congress’ https://www.mediagistic.com/$2.2 trillion economic stimulus package contains nearly $400 billion in small business loans and a tax credit for small businesses (500 employees or less) that retain workers.

- With the proliferation of stay-at-home orders, ACHRNEWS reports, “many people spending extra time in their homes will start looking at repairs and upgrades they otherwise ignored.”

- Sports radio is currently garnering increased engagement, despite (and perhaps because) sports are on a hiatus worldwide. Meanwhile, billboards are suddenly less appealing to brands because there are fewer people driving on roads.

- Facebook and Twitter are both experiencing unprecedented user growth, but advertisers are still pulling back on ad spends.

Eddie Childs is the Inbound Marketing Manager for Mediagistic. His writing has been published by a range of websites and publications including Copypress.com, Jambase.com, NFLSoup.com, FootballNation.com, and Boating World, KnowAtlanta, Men’s Book, Cobb in Focus, TCL, Blush, Charged Electric Vehicles, Business to Business, and Catalyst magazines. Follow him on Twitter and connect with him on Linkedin.

Featured image via Getty Images

You May Also Like

Branding on a Budget: How Local HVAC Dealers Can Compete Without Private Equity Dollars

March 4, 2026Private equity–backed HVAC brands often have massive marketing budgets. But local, family-owned dealers have something just as powerful: authenticity, community presence, and… Continue Reading Branding on a Budget: How Local HVAC Dealers Can Compete Without Private Equity Dollars…

Mediagistic Earns 2026 Google Premier Partner Status, Ranking Among the Top 3% of Agencies Nationwide

February 24, 2026Mediagistic is proud to announce that we have once again earned Google Premier Partner status for 2026. This distinction places us among… Continue Reading Mediagistic Earns 2026 Google Premier Partner Status, Ranking Among the Top 3% of Agencies Nationwide…

EPIC 2026 Recap: What Getting 1% Better Means for HVAC Marketing in 2026

February 19, 2026The Main Event of HVAC delivered exactly what the industry needed. At EGIA’s EPIC 2026, contractors, distributors, and partners from across the… Continue Reading EPIC 2026 Recap: What Getting 1% Better Means for HVAC Marketing in 2026…